How to set up lending conditions

The [Sales condition] page is designed for setting up those product characteristics that change depending on the specifics of a sale, for example, the correlation between the interest rate and the term of the loan, special conditions for different customer categories, etc.

Here we will set up an example of lending conditions for a loan product in which the interest rate depends on the customer segment, loan term, and amount.

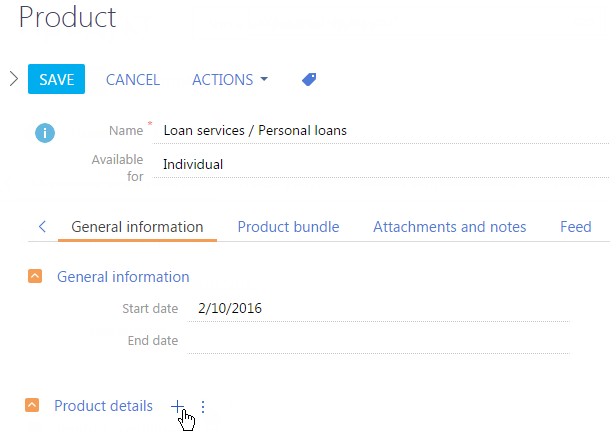

1.Go to the [Products] section and open the needed product page.

2.Click the  button on the [Product details] detail (Fig. 1).

button on the [Product details] detail (Fig. 1).

Fig. 1 Adding a product condition

3.Go to the [Sales conditions] tab.

4.Click the  button on the [Sales conditions] tab (Fig. 2).

button on the [Sales conditions] tab (Fig. 2).

Fig. 2 Adding opportunity conditions

5.On the opened page:

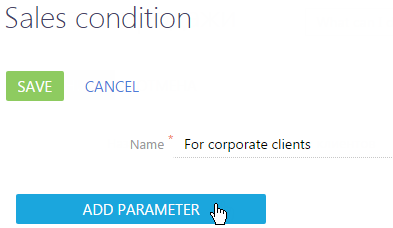

a.Enter the lending condition name, for example, “For corporate customers”.

b.Click the [Add parameter] button (Fig. 3).

Fig. 3 Creating opportunity conditions

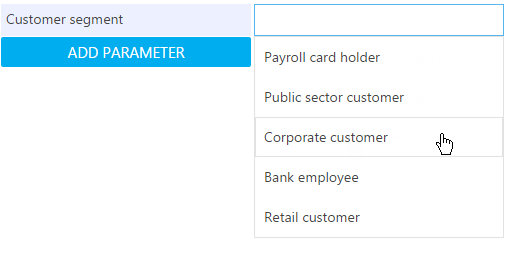

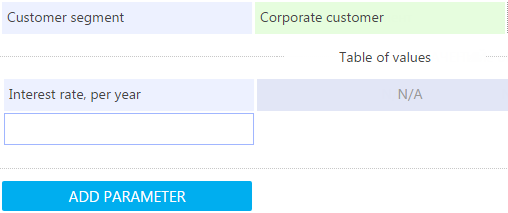

6.In the appeared field select the “Customer segment” and specify “Corporate customer” value for it (Fig. 4).

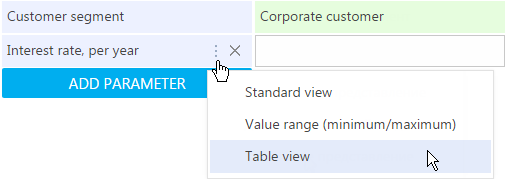

7.Click the [Add parameter] button and select “Interest rate, yearly”.

8.Change the view of the value entry field to table view:

a.Place the cursor over the selected value.

b.Click the  button.

button.

c.Select “Table view” (Fig. 5).

Fig. 5 Selecting table view to create opportunity conditions

As a result, the [Interest rate, yearly] parameter will switch to the table view (Fig. 6).

Fig. 6 Table view of an opportunity condition parameter

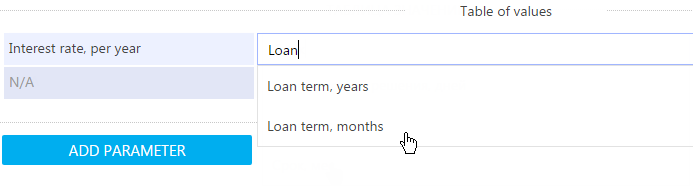

9.Select [Loan term, months] in the right part of the table (Fig. 7).

Fig. 7 Opportunity condition in a table view

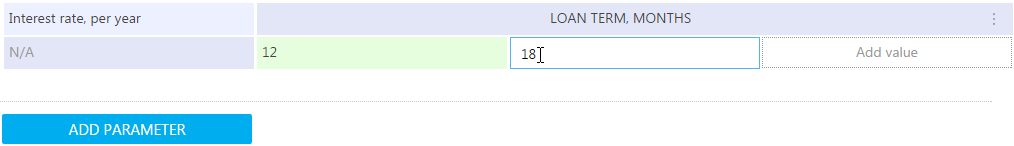

10.Specify the terms in months for which the loan can be granted in months (Fig. 8).

Fig. 8 Specifying the loan terms

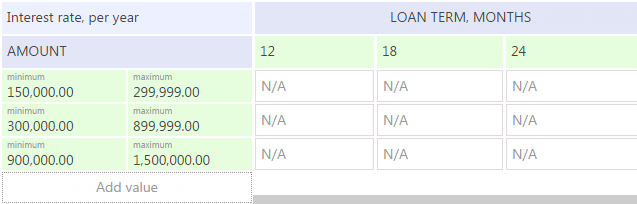

11.In the left part of the table, select the “Amount” value, and specify available ranges for the credit amount (Fig. 9).

Fig. 9 Formulating the credit amount ranges

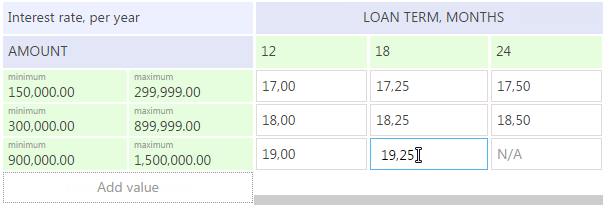

12.Specify the interest rates for each intersection of the loan term and the amount (Fig. 10).

Fig. 10 Formulating interest rates that depend on the loan terms and amounts

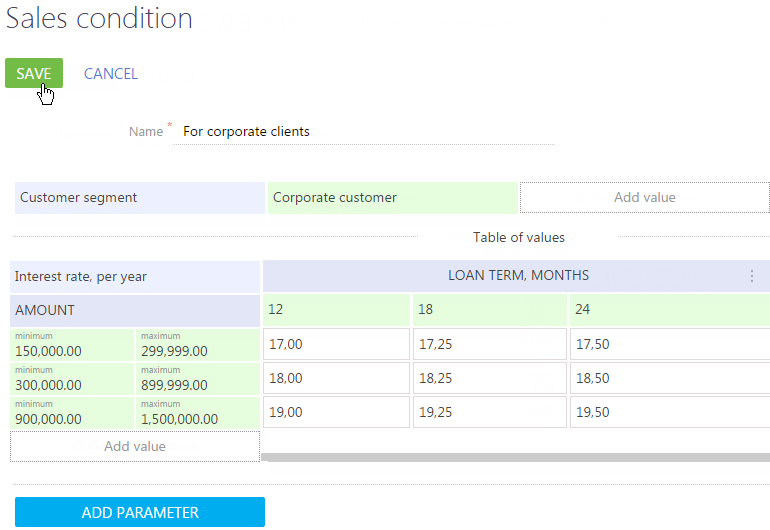

13.Click the [Save] button to save the generated table of the opportunity conditions.

As a result, opportunity conditions will be formed for the corporate customers of your bank (Fig. 11). For example, if a corporate customer applies for a loan of 300 000 USD for 12 months, the interest rate will be automatically set to 18%.

Fig. 11 Formulated product opportunity conditions

See also

•How to specify product details

•How to set up customer parameters

•How to set up product features

•How to set up the document package