An application for bank products is created by the loan processor employee at the bank office based on the information provided by a borrower. Applications are created in two stages: quick application creation and filling in detailed application information.

Example

A consumer wishes to take a loan of $50,000 for a period of 3 months.

How to create an application

Adding a new application is simple: just fill in the required fields. You can add other information later, using the application page. To create an application:

1.Click the [Add application] button in the [Applications] section.

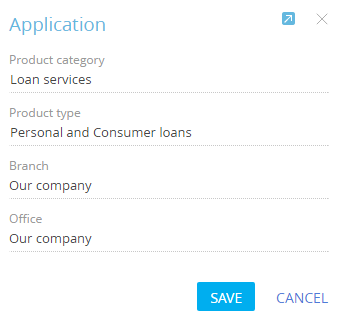

2.In the opened mini page, all fields are populated automatically. "Lending" and "Consumer lending” values are specified, respectively in the [Product category] and [Product type] fields by default. Change the field values if the consumer is interested in the products of another category or type. Information about bank subsidiaries and branches is filled in based on the data about the place of work of the employee who creates an application (Fig. 1).

3.Save the application.

How to fill in an application

Before you can start processing the application, it must contain the following information: product, deal participants and the documents required for the deal. This information is required for application validation, during which the final decision on the deal is made.

On the new application page, you will be asked to fill in the information about the selected product. The corresponding activity will be displayed on the action panel. Ask the customer about the product and its conditions. Enter the information on the application page:

On the application page, fill out the [Selected product] tab.

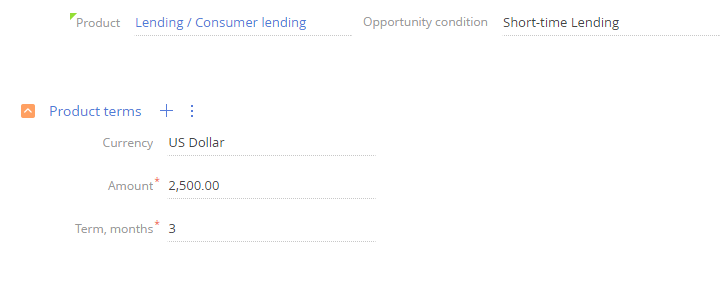

1.Specify the product for which the application is created. Only products whose category and type coincide with those specified during application creation are available for selection in the [Products] field. If the terms of sale are set for the selected product, select the product with the most suitable conditions in the list. In this case, we select the Lending/Consumer lending/Short-term loans. After selecting a product, the list of conditions on the application page will be filled in automatically.

Note

Product conditions include a full banking product profile and sale conditions. Product condition setup is described in a separate article.

2.Specify the currency of the loan, its amount, term and other required parameters. In our case it is $50 000 loan for 3 months (Fig. 2).

Fig. 2 An example of filled out [Selected product] tab

Participants and documents

Fill the information about deal participants after entering the product information in the application. You can do this on the “Filling in the application form” stage.

On the “Filling in the application form” stage, another activity will be created. When you click on the activity, the automatically created borrower application form will open. Fill out the application form. A list of documents for the borrower will be generated automatically. When the application form is saved, you will be asked to send the application for validation:

-

If all information on the application has been entered, click [Yes] and click the [Save] button. The application will enter the "Validation" stage.

-

To add information to the application (for example, the “Guarantor” application form), click the [Perform later] button and specify the start time, activity duration and reminder time. The created task will appear on the application action panel.

-

If the application requires significant revision, click [No]. After revising the application, send it for validation by clicking on the corresponding stage of the indicator on the application page.

Note

The application page provides a complete list of documents for all deal participants. The list of documents for each participant is available on the application form page.

Note

The required documents can be set up in the product conditions.

See also